🎓 Why Financial Aid Transparency Matters for College Students

Lobbying for better financial aid disclosure isn’t just a bureaucratic issue—it’s a fight for student empowerment and informed decision-making. As tuition and debt loads continue to rise, clear, consistent, and comprehensive financial aid communication becomes critical to prevent misinformation, poor borrowing decisions, and future financial instability.

📊 The Problem With Current Financial Aid Letters

Most financial aid award letters lack standardization. They often use vague terms, omit key figures like the true cost of attendance, and fail to distinguish between grants, scholarships, and loans. This leads to widespread confusion among incoming students and their families, especially first-generation college attendees.

Inconsistent formatting can bury the fact that a large portion of the aid offered is actually debt. In some cases, loans are presented as if they were grants, encouraging students to accept offers without understanding the full repayment burden they’re committing to.

🧠 Behavioral Economics and Student Decision-Making

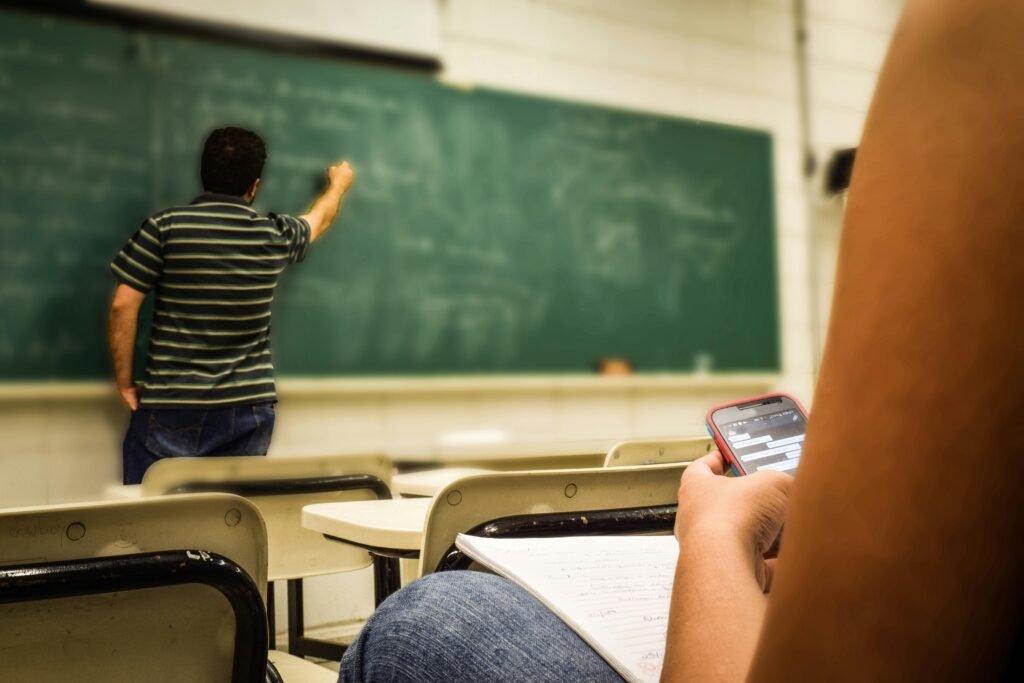

Research in behavioral economics shows that young adults are especially susceptible to framing effects—how a message is presented can significantly impact how it is perceived. If loans are framed as “awards,” students are more likely to accept them without critical analysis. Transparency combats this by allowing informed comparisons and budgeting strategies before committing to a college program.

🎓 Why Financial Aid Transparency Matters for College Students

Lobbying for better financial aid disclosure isn’t just a bureaucratic issue—it’s a fight for student empowerment and informed decision-making. As tuition and debt loads continue to rise, clear, consistent, and comprehensive financial aid communication becomes critical to prevent misinformation, poor borrowing decisions, and future financial instability.

📊 The Problem With Current Financial Aid Letters

Most financial aid award letters lack standardization. They often use vague terms, omit key figures like the true cost of attendance, and fail to distinguish between grants, scholarships, and loans. This leads to widespread confusion among incoming students and their families, especially first-generation college attendees.

Inconsistent formatting can bury the fact that a large portion of the aid offered is actually debt. In some cases, loans are presented as if they were grants, encouraging students to accept offers without understanding the full repayment burden they’re committing to.

🧠 Behavioral Economics and Student Decision-Making

Research in behavioral economics shows that young adults are especially susceptible to framing effects—how a message is presented can significantly impact how it is perceived. If loans are framed as “awards,” students are more likely to accept them without critical analysis. Transparency combats this by allowing informed comparisons and budgeting strategies before committing to a college program.

💡 Historical Context of Financial Aid Reform

The push for better financial aid disclosure isn’t new. Advocacy efforts date back to the early 2000s, but momentum grew significantly following the 2008 financial crisis. As student debt levels reached national attention, lawmakers and watchdog organizations began calling for greater accountability from institutions receiving federal aid dollars.

📜 Legislative Attempts and Their Shortcomings

Congress and the Department of Education have proposed several initiatives to standardize financial aid offers. The “College Financing Plan” (formerly the Shopping Sheet) was one such attempt, but its adoption was voluntary, and many colleges still refuse to comply. Without mandatory compliance, inconsistency remains rampant.

🗳️ Grassroots Movements for Change

Student-led and nonprofit coalitions have increasingly taken the lead in demanding transparent financial aid policies. These groups lobby both federal and state governments to require colleges to adopt standardized templates, improve plain-language communication, and disclose the full cost of attendance upfront, including room, board, books, and hidden fees.

💥 The Emotional Impact of Poor Disclosure

Many students who later default on their loans report being unaware of the terms when they accepted the aid. This contributes to long-term stress, damaged credit, and diminished access to economic mobility. In fact, understanding the consequences of student loan default has become essential to protecting future borrowers.

To grasp the severity of poor borrowing decisions, it helps to understand what happens if you default on student loans. The long-term penalties are severe, including wage garnishment, tax refund seizures, and loss of eligibility for future federal aid.

📣 Strategies for Advocacy and Reform

Students, parents, and concerned citizens can play a critical role in lobbying for change. This includes contacting elected officials, joining public comment sessions on Department of Education rulemaking, and supporting nonprofit efforts dedicated to higher education reform.

🛠️ Tactics That Work in Lobbying Campaigns

- Organizing petition drives that highlight personal stories of confusion or harm

- Meeting with state legislators and providing sample award letters that illustrate discrepancies

- Partnering with journalists to amplify the narrative and pressure institutions

- Using social media campaigns to engage students across campuses and build collective momentum

When students unite around shared concerns, their voice becomes harder to ignore. The more visible the issue, the more likely it is to attract bipartisan attention in Congress—especially as more families across the income spectrum are affected by unclear financial terms.

🏛️ Colleges’ Resistance to Reform

Despite the growing call for transparency, many institutions resist reform efforts. Colleges argue that financial aid packages must remain flexible due to program complexity and institutional autonomy. But this lack of standardization keeps families in the dark and undermines their ability to compare offers meaningfully.

🚧 Hidden Barriers for Marginalized Students

Low-income and underrepresented students often face greater challenges navigating unclear financial offers. These students are more likely to attend institutions with lower graduation rates, higher loan default rates, and limited financial counseling. Without reform, the lack of transparency deepens socioeconomic divides and perpetuates educational inequality.

📢 The Historical Lack of Transparency in Financial Aid

For decades, higher education institutions have faced criticism for presenting financial aid packages in ways that mislead or confuse students and their families. The lack of standardized formatting, inconsistent definitions of terms, and the blending of grants and loans in award letters have made it difficult for students to understand what they are truly being offered—and what they owe. This longstanding opacity has played a significant role in the growing student debt crisis.

📢 The Historical Lack of Transparency in Financial Aid

For decades, higher education institutions have faced criticism for presenting financial aid packages in ways that mislead or confuse students and their families. The lack of standardized formatting, inconsistent definitions of terms, and the blending of grants and loans in award letters have made it difficult for students to understand what they are truly being offered—and what they owe. This longstanding opacity has played a significant role in the growing student debt crisis.

🔍 Ambiguity in Award Letters

Many award letters fail to clearly distinguish between loans and gift aid, sometimes listing loans alongside grants without specifying repayment terms. Some letters omit total cost of attendance or include confusing language like “net cost,” which can mean different things depending on the school. This ambiguity can mislead families into overestimating how much support they are receiving, contributing to over-borrowing and financial hardship later on.

📉 The Impact of Deceptive Practices

Studies have shown that when students misunderstand their aid packages, they are more likely to take on unnecessary debt or drop out due to financial stress. This disproportionately affects first-generation and low-income students, who may lack access to independent financial guidance. Clearer communication could prevent these outcomes and increase college completion rates.

🧭 Federal Efforts Toward Standardization

In recent years, federal agencies have recognized these issues and attempted to intervene. The Department of Education launched the College Financing Plan (formerly the Financial Aid Shopping Sheet), a standardized form that institutions can voluntarily adopt. While this form provides consistent information across schools, its optional nature limits its reach.

📄 Elements of the College Financing Plan

- Breakdown of direct and indirect costs

- Clear separation of grants, scholarships, and loans

- Estimated monthly loan payments after graduation

- Graduation and loan default rates

Despite its benefits, adoption of the College Financing Plan has been uneven. Some institutions argue that it oversimplifies complex financial packages or doesn’t align with their internal systems. As a result, students are still often presented with inconsistent formats across schools.

🤝 Role of Policy Advocacy and Grassroots Movements

Recognizing the slow pace of institutional change, advocacy groups and student organizations have stepped in to push for mandatory standardization. Groups like the uAspire and The Institute for College Access & Success (TICAS) have proposed legislation and guidelines to make financial aid letters more transparent and uniform across all colleges.

📢 Legislative Momentum

Several bipartisan bills have been introduced in Congress, such as the Understanding the True Cost of College Act, which would require all colleges participating in federal aid programs to use a standardized financial aid award letter. These proposals have received support from consumer rights organizations and financial aid experts, though lobbying from some colleges has slowed progress.

📊 How Transparency Affects Student Decisions

Clarity in financial aid offers can significantly impact student enrollment choices. When students can accurately compare offers side by side, they’re better equipped to choose affordable options, potentially avoiding high-debt outcomes. Research indicates that greater transparency can increase enrollment at lower-cost institutions and reduce default rates over time.

According to recent education policy studies, improving disclosure practices is among the most cost-effective strategies to address student debt. Alongside broader reforms, transparent aid packages help students understand not only what they’re receiving—but also what future obligations they’re committing to. This awareness fosters better budgeting, responsible borrowing, and informed long-term planning.

📘 The Role of Financial Literacy in Interpreting Aid

While reforming disclosure standards is critical, it must be paired with initiatives that build financial literacy. Many students enter college without a solid grasp of borrowing, interest rates, or repayment schedules. Without these foundational skills, even clear award letters can be misinterpreted.

📚 Schools and Nonprofits Offering Support

Some colleges are taking the lead by offering financial literacy workshops during orientation or requiring completion of budgeting modules before disbursing aid. Nonprofit programs also provide free financial counseling to students and families, helping them interpret award letters and understand loan implications. A deeper financial education empowers students to advocate for themselves and make more sustainable decisions.

🔗 Aligning With Broader Reform Goals

Efforts to increase financial aid transparency intersect with wider college affordability movements, including tuition caps, expanded need-based aid, and forgiveness initiatives. As more students and families scrutinize higher education costs, pressure is mounting for colleges to eliminate deceptive practices and embrace reforms. In fact, some advocates argue that clear disclosures are a prerequisite for other changes to take hold.

This growing awareness aligns with other student-centered initiatives, such as those aimed at helping students understand the true value of college offerings. One relevant discussion appears in the article How to Evaluate If College Is Worth It in 2025, which offers insights on balancing cost, quality, and post-graduation outcomes.

📢 Empowering Students Through Policy Transparency

At the core of lobbying for financial aid disclosure reform lies the commitment to transparency, fairness, and informed decision-making. Colleges often release complex, non-standardized financial aid letters that leave students confused about the true cost of attendance. This ambiguity disproportionately affects low-income and first-generation students, perpetuating cycles of debt and misinformation. Reform efforts are vital to bring clarity, comparability, and justice to the financial aid process.

True reform requires more than incremental improvements. It involves cultural change across higher education institutions and bold advocacy that centers student rights over institutional convenience. Transparency in financial communications helps shift power back to the student and aligns institutions with ethical education practices.

📊 Standardizing Award Letters Across the Nation

A crucial aspect of reform is pushing for uniform financial aid award letters. The current lack of a national standard allows colleges to present offers in ways that are intentionally or unintentionally misleading—masking loans as grants, omitting cost-of-living estimates, or burying essential terms. Advocacy groups, policy think tanks, and even bipartisan lawmakers have called for mandated templates that clearly distinguish between gift aid and debt, and include net cost projections.

Federal-level efforts like the College Financing Plan (formerly the Shopping Sheet) aim to standardize information, but adoption is voluntary. To make real change, lobbying efforts must focus on making these formats mandatory across all federally funded institutions.

⚖️ The Role of State Legislation and Legal Advocacy

While federal reforms are pivotal, much of the immediate traction can come from state-level laws. Several states have passed legislation requiring colleges to disclose net price estimates and break down financial aid components. These laws serve as models that can be adapted nationwide through coordinated lobbying campaigns.

Legal organizations have also begun using litigation to force disclosure changes. If a school provides misleading financial data, it can face legal challenges under consumer protection laws. Strategic lawsuits, combined with public pressure and media coverage, can accelerate institutional compliance with transparency standards.

📍 Grassroots Student Advocacy as a Catalyst

Policy lobbying becomes most powerful when it is fueled by grassroots momentum. Students who share their financial aid confusion or debt mismanagement stories can influence public sentiment and legislative will. College-based clubs, student government bodies, and youth-led organizations are increasingly taking on advocacy roles once dominated by lobbyists and policy experts.

Equipping students with civic education and policy knowledge strengthens their voices. When campus leaders present testimonies, meet with legislators, or launch petitions for clearer disclosure policies, they demonstrate that the student body is not passive—it is politically aware and engaged.

📣 Coalition Building for National Impact

Effective lobbying doesn’t happen in silos. Success depends on coalition building among nonprofits, legal experts, student groups, media partners, and legislators. By presenting a unified front, advocates can amplify their demands and broaden their political reach. Many organizations are already doing this by creating toolkits, policy templates, and media kits to support transparency reform efforts.

For example, reformers are drawing from lessons learned in healthcare and environmental policy—where standardization and public communication became non-negotiable over time. By framing financial aid disclosure as a civil rights and consumer protection issue, reform advocates can expand their base and moral urgency.

🗂️ Integrating Reform With Broader Equity Goals

Financial aid disclosure reform does not exist in isolation. It intersects with racial equity, income mobility, and access to higher education. Colleges that fail to disclose true costs reinforce inequalities—pushing marginalized students into deeper debt or discouraging enrollment altogether.

Integrating reform goals with broader equity initiatives—such as diversity scholarships, first-gen mentoring, and campus inclusion strategies—ensures that financial transparency becomes a pillar of institutional accountability. Colleges must be reminded that financial clarity isn’t optional; it’s a moral obligation tied to their public trust and funding.

💡 Conclusion

Challenging the opacity of financial aid disclosure requires bold, coordinated lobbying that centers student needs and systemic equity. Reform efforts must tackle the root causes of confusion—from vague language to strategic omissions—while pushing for clear, standardized, and enforceable guidelines. Empowered students, transparent policies, and ethical institutions are the foundation of a fairer college financing system.

As new generations of students rise, their voices must be met with clarity, not confusion. Their futures should be paved with opportunity, not obscured by financial uncertainty. Lobbying for reform is not just a political act—it is a commitment to fairness, justice, and the true promise of higher education.

❓ FAQ

Q: What are the main problems with current financial aid letters?

Current financial aid letters often use inconsistent formats and vague terms, making it difficult for students to compare offers or understand actual costs. This lack of clarity can lead to overborrowing or choosing unaffordable schools.

Q: How can students get involved in financial aid disclosure reform?

Students can join advocacy groups, testify at state hearings, contact their legislators, and share their financial aid experiences online. Colleges and student governments are also great platforms for organizing and demanding change.

Q: Are there any examples of successful reform?

Yes. States like New York and California have introduced laws requiring standardized disclosures, and many colleges have voluntarily adopted the College Financing Plan. These efforts show that reform is possible with pressure and persistence.

Q: Does financial transparency really affect student success?

Absolutely. When students understand their financial options clearly, they are more likely to stay enrolled, graduate on time, and avoid burdensome debt. Transparency supports both academic performance and mental wellbeing.

This content is for informational and educational purposes only. It does not constitute investment advice or a recommendation of any kind.

Navigate student loans, budgeting, and money tips while in college here: