🤝 The Financial Realities of Group Projects in College

Group projects are a staple of academic life, designed to build collaboration, leadership, and real-world problem-solving skills. But behind the educational benefits lies a hidden challenge: managing shared budgets and expenses. From buying supplies and printing materials to splitting subscriptions or travel costs, group projects can quickly become financial headaches—especially for college students on a tight budget.

Unlike individual spending, group budgeting requires consensus, transparency, and accountability. Without the right tools and systems in place, even a simple presentation can trigger miscommunication, overspending, or unequal contribution. This is particularly true in mixed-income teams where some students may feel uncomfortable voicing financial concerns.

🧾 Why Budgeting Tools Matter for Group Work

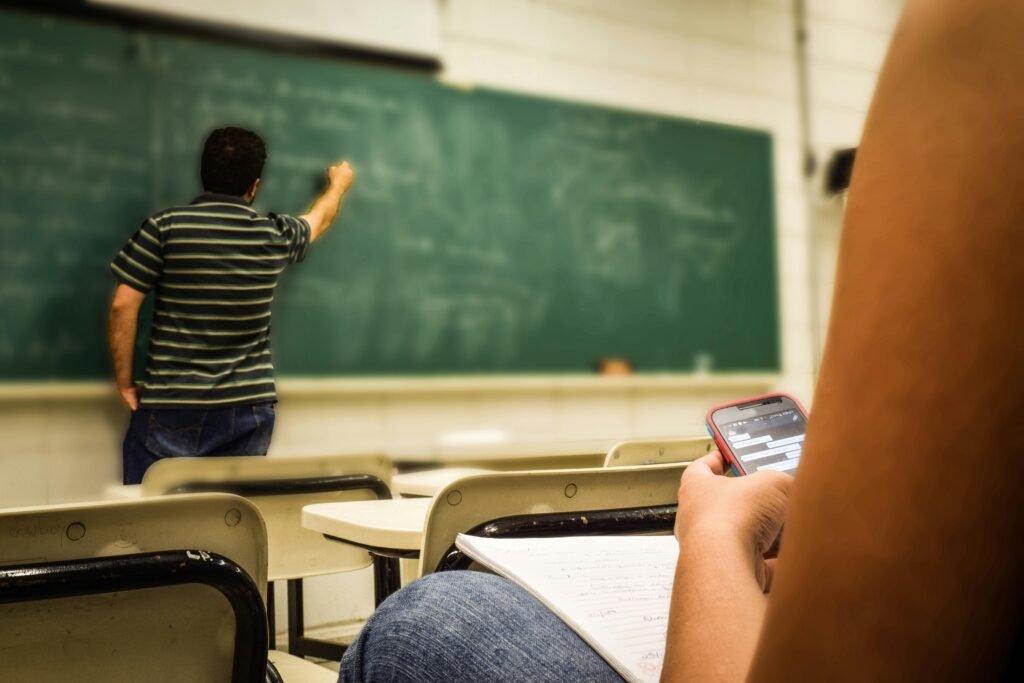

Many students rely on informal tools like texting or Venmo to manage group finances. While convenient, these methods rarely offer visibility or structure. Budgeting tools specifically designed for collaboration not only streamline cost-sharing but also build financial literacy, mutual respect, and equity among team members.

Using shared tools creates a central point of truth: who spent what, when, and why. This minimizes awkwardness, builds trust, and helps everyone focus on the project instead of stressing about fairness or repayment.

📱 Top Free Tools for Managing Group Project Budgets

Fortunately, students today have access to powerful, low-cost digital tools that make tracking and sharing group budgets easy. These apps support real-time updates, custom categories, and exportable reports—perfect for academic settings where collaboration is key.

📊 Splitwise: Simplifying Shared Costs

Splitwise is one of the most popular apps for shared expense tracking. Users can log purchases, split costs evenly or unevenly, and set reminders for unpaid balances. It’s ideal for teams that need a quick, mobile-first way to monitor who paid for what—and who owes whom.

Bonus: It integrates with PayPal and Venmo for seamless repayment.

🧮 Google Sheets + Templates: The DIY Budget Dashboard

For more customizable tracking, Google Sheets remains a top choice. Using shared templates, groups can track expenses, assign categories, and even forecast costs. With Google’s collaboration tools, every team member can comment or update the budget in real time.

To elevate this experience, consider applying the principles outlined in this personal finance dashboard guide. Although it’s designed for individual use, the same structure can be adapted for project teams. Using dynamic sheets with charts and conditional formatting gives everyone visual clarity and insight.

💡 Choosing the Right Tool for Your Team

The best tool for your group depends on the scope of the project, the level of detail required, and your team’s digital habits. If everyone already uses Google Drive, Sheets may be the most frictionless option. If the goal is casual tracking, a mobile app like Splitwise or Tricount will likely work best.

✅ Features to Look For

- Real-time updates with notifications

- Ability to split expenses unequally

- Export functionality for reporting to professors or clubs

- Cloud-based access and permissions

- Commenting and note-taking capabilities

Whichever platform you choose, it should simplify—not complicate—your collaboration. Look for tools that feel intuitive to the entire group, not just the most tech-savvy member.

📦 Organizing Project Expenses: What to Track

One common mistake in group budgeting is under-tracking. Teams may remember to log big purchases like software or printing but forget smaller expenses like snacks during meetings or parking at the library. These “micro-costs” add up fast and can create resentment if left unaddressed.

🔍 Common Group Project Expenses to Log

- Materials (poster board, USB drives, binders)

- Software or app subscriptions (e.g., Canva, Grammarly)

- Printing and presentation costs

- Transportation or parking

- Shared meals or snacks during team sessions

- Guest speaker or volunteer thank-you gifts

Encourage your team to log every expense, no matter how small. Set a shared goal: 100% visibility. When everything is documented, it’s easier to adjust, reimburse, or even cut costs mid-project.

🧠 Building Shared Accountability and Communication

Even with the best tools, budget collaboration fails without communication. First-generation and lower-income students may hesitate to speak up about costs, especially if team dynamics make them feel isolated or judged. Normalize financial transparency from day one by setting ground rules for spending, contribution, and budget limits.

Tools like shared budgeting apps allow for passive accountability—members can view and reflect on spending trends without confrontation. To take it further, consider the peer systems discussed in this guide to peer accountability. Applying those methods in a group project context boosts not only financial equity but also social trust.

💬 Tips for Collaborative Financial Success

- Assign one budget “lead” to input expenses—but rotate weekly for fairness

- Schedule short budget check-ins during project meetings

- Use emojis or tags to indicate which costs are pending reimbursement

- Agree on a spending cap and flag any exceptions before purchase

Making money talk part of your group culture changes everything. It leads to fewer surprises, greater respect, and better decisions overall.

📈 Leveraging Budget Tools for Graded Projects

Some professors now ask students to present not only their project results but also their process. A well-maintained budget spreadsheet or expense report can double as proof of organization, transparency, and leadership. It also becomes a professional tool students can use to showcase their teamwork and planning skills.

Using collaborative tools like Google Sheets, Notion, or Airtable shows initiative and reflects real-world project management experience. It demonstrates that your team not only executed a strong idea—but did so within constraints and with clear communication.

🛠️ Advanced Tools and Strategies for Group Budget Collaboration

Once your team has identified a shared budgeting tool, it’s time to level up with more advanced features and strategic approaches. Tools like Notion, Airtable, Trello, and even Microsoft Teams offer budgeting modules and integrations that go beyond simple spending tracking. They help teams manage timelines, assign tasks, and ensure every dollar is tied to a deliverable or milestone.

Choosing the right integrated platform can reduce redundancy, keep communication clear, and streamline both project and financial management. Whether you’re planning an event, a capstone project, or a startup prototype, an all-in-one workspace can reduce friction and increase accountability.

🌐 Collaborative Platforms with Financial Features

- Notion – Create a shared table or database that logs expenses, syncs with task boards, and lets your team comment inline

- Airtable – Use custom fields for cost categories, cost owners, invoices, and even approval status

- Trello + Power-Ups – Use card labels for budget status, attachments for receipts, and automation for reminders

- Microsoft Teams – Integrate Forms or Excel as tabs and store collaborative expense worksheets right where your team chats

These environments support collaboration beyond finance—they also allow you to layer your project’s timeline, deliverables, and responsibilities for holistic tracking.

📈 Real-Time Budget Tracking and Reporting

One benefit of structured platforms like Airtable or Notion is the ability to turn raw data into actionable visuals. Embed charts, dashboards, or Kanban boards to illustrate which tasks align with budget and which expenses are upcoming. Regularly shared visual snapshots reinforce transparency and empower decision-making collectively.

📉 Budget Dashboards: Visuals That Drive Results

- Monthly or weekly expense breakdowns by category

- Pending reimbursements or unpaid balances at a glance

- Remaining budget vs actual spend, visualized

- Receipts or invoice images linked directly to entries

Not only do these visuals support internal clarity, but they can also serve as evidence of professionalism if your team needs to submit documentation to instructors or sponsors.

💬 Integrating Budgeting with Communication and Workflow

Financial tools shouldn’t live separately from your everyday workflow. Embedding your budget dashboard into your project’s communication app—like Slack or Microsoft Teams—ensures everyone stays informed without opening multiple platforms.

📡 Communication Features to Watch For

- Automated alerts for unapproved expenses or overspending

- Comment threads attached to specific line items

- Tag-based notifications for cost approvers or finance leads

- Approval workflows for larger purchases or group funding decisions

This structure prevents tension, ensures financial visibility, and keeps conversations tethered to specific expenses rather than general anxieties.

📌 Best Practices for Fair and Efficient Budget Sharing

Implementing tools is only half the equation. Teams must align on norms and expectations. Establish clear roles (e.g., budget lead, approver, receipt uploader), set spending thresholds, and define decision-making rules up front. Consider creating a brief team agreement document outlining process and rules.

📝 Sample Budget Collaboration Agreement

- Each purchase above $10 must be logged with receipt and description

- Major expenses (above $50) require group approval before purchasing

- All members review the shared budget weekly during team meetings

- Unpaid balances are requested within 72 hours of purchase

With a simple agreement in place, financial misunderstandings are far less likely—and everyone shares accountability equally.

💡 Case Study: Combining Tools & Peer Principles

In practice, a team might use Airtable as the centralized budget tracker, embed it into Slack for accessibility, and take inspiration from peer accountability models to build a systems mindset. For example, borrowing ideas from how roommates or study groups share goals (as in this peer accountability guide) can reinforce habits like weekly reconciliations or rotating finance responsibilities. These structures support both financial equity and relational trust.

🔄 Habit-Driven Financial Culture

- Rotate the ‘budget captain’ role each week to share ownership

- Trigger automatic reminders (via Slack or Teams) for expense logging

- Track reimbursement status visually (e.g. green/pending/red) in dashboard

- Celebrate milestones—like when the budget hits 90% spent or project completes under budget

These rituals build efficiency, clarity, and shared financial respect—skills that extend beyond one project into real-world collaboration.

📦 Preparing Final Budget Reports for Professors or Stakeholders

Some classes or organizations require detailed breakdowns of project spending. A polished spreadsheet or embedded Notion/Airtable view can serve as proof of planning, organization, and ethical teamwork. Label each expense clearly, categorize by item or phase, and provide totals vs budgeted amounts.

📄 Report Contents That Impress

- Summary page showing total budget, spend, and variance

- Expense log with dates, descriptions, amounts, and responsible member

- Visual graphs or charts highlighting spending trends or category splits

- Receipts or documentation links available via cloud integration

This level of reporting doesn’t just support group success—it showcases leadership, responsibility, and project maturity to instructors or sponsors.

🙏 Encouraging Accountability Without Tension

Groups often avoid financial conversations to preserve harmony—but silence breeds imbalance. Normalizing transparent cost-sharing and equality from the start—and modeling respectful accountability—reduces friction. Assigning a lead doesn’t centralize power—it shares process, and having clear norms ensures every voice is heard.

👍 Encouragement Practices

- Publicly acknowledge members who log expenses accurately and on time

- Hold post-project reflections on what money practices worked well

- Invite anonymous feedback on budget experiences for future improvement

This culture of respect and routine planning supports both finances and relationships—and sets a precedent for future collaborations.

🚀 Scaling Up: Integrating Budget Tools with Project Workflow

Scaling up budgeting for group projects means embedding shared financial tools within your core collaboration platform. Connect Airtable, Notion, or Trello with Slack, Microsoft Teams, or Google Workspace to enhance transparency and streamline communication. When budgeting lives alongside task tracking and deadlines, financial clarity becomes part of everyday project flow—not an afterthought.

Consider approaches from the guide on peer accountability, adapting team norms like rotating cost roles and weekly reconciliations. These habits foster mutual trust, improve documentation, and create emotional ease around budget conversations.

📌 Cross‑Platform Financial Integration

- Embed the budget tracker in your main communication hub (Slack, Teams, etc.)

- Use alerts or tags for overdue reimbursements or unapproved expenses

- Attach proof (receipts, screenshots) directly to expense items

- Privilege transparency—everyone sees updates immediately

💬 Fostering Team Equity and Financial Inclusion

Not all team members may feel comfortable expressing financial concern—especially in diverse or economic-challenged groups. Combat this by setting upfront norms: allow rotating financial roles, permit reimbursement after delivery milestones, and offer options for silent contribution. This ensures equitable involvement without shame or exclusion.

✨ Equity Practices within Group Budgeting

- Rotate the “budget captain” weekly to share responsibility

- Allow anonymous logging of expenses if members prefer privacy

- Encourage open feedback around spending practices mid-project

- Set agreed spending caps and flag unusual costs before purchase

🔍 Final Reporting: Presenting Budget Insights as Evidence of Team Maturity

Beyond mere numbers, final budget reports convey leadership. Include a polished summary view—such as in Notion, Airtable, or Google Sheets—with charts and clear documentation. Professors or sponsors appreciate seeing not just results, but the process behind them.

📄 Impactful Report Elements

- Visual overview: total spend vs. planned budget

- Itemized expense log with dates and responsible members

- Charts or graphs showing category breakdowns or timeline usage

- Attached proof of purchase or reimbursement statuses via cloud links

❤️ Conclusion

Effectively managing group project budgets teaches far more than fiscal responsibility—it cultivates leadership, equity, and collaborative resilience. By choosing appropriate tools, normalizing budget transparency, and reflecting as a team, you transform group work into a demonstration of maturity and respect. These skills ripple beyond the classroom, preparing you for real-world teamwork where financial clarity matters.

❓ FAQ

Q: Should we use the same budgeting tool for every project?

Not necessarily. Tailor your approach based on team size, project complexity, and members’ tool familiarity. For quick tasks, Splitwise or Tricount may suffice. For longer or high-stakes projects, Airtable, Notion, or integrated dashboards offer far more control and documentation value.

Q: How do we handle members who can’t afford to advance money?

Allow flexibility in group financial roles—rotate expense responsibility, enable reimbursements after deliverables, or support pre-approved budget draws. The goal is equity, not pressure, and shared norms reduce discomfort.

Q: Can these tools help us earn higher project grades?

Yes. Tools that document spending, transparency, and planning—especially when shared as part of your presentation—demonstrate professionalism and planning maturity. They can make a positive impression on professors or external stakeholders.

Q: What if someone disagrees with expense entries at the end?

Use peer review: assign expense cross-verifiers who confirm logs weekly or before submission. Facilitate calm conversations and document agreed resolutions. Keeping an audit trail and clear communication reduces conflict.

This content is for informational and educational purposes only. It does not constitute investment advice or a recommendation of any kind.

Navigate student loans, budgeting, and money tips while in college here: