🎓 Why Automated College Savings Matter More Than Ever

College tuition continues to rise at an alarming rate. In the United States, the average cost of attending a four-year public institution now exceeds $27,000 per year when factoring in tuition, housing, books, and miscellaneous expenses. For private colleges, that number skyrockets even further. In this climate, families and students alike are seeking smarter, more efficient ways to save for college without sacrificing quality of life or financial stability. This is where automation plays a crucial role.

Automating college fund deposits removes the friction of manual contributions and builds consistency over time. With the right tools and strategies, even small recurring deposits can grow into substantial education funds—especially when started early. This makes automated apps a game-changer for families trying to navigate rising costs, inflation, and shifting economic landscapes.

💡 The Power of Consistency in College Savings

One of the most overlooked benefits of automation is consistency. When deposits happen on a schedule—weekly, biweekly, or monthly—they compound over time. This not only builds discipline but also eliminates the emotional resistance that often blocks people from saving regularly. Automation brings structure to what would otherwise be a vague, anxiety-inducing goal.

Additionally, consistent saving builds momentum. Watching your college fund grow month after month creates a psychological feedback loop that motivates continued contributions. Even if the initial amounts are small, automated saving instills a habit that can last through high school, college, and beyond.

📱 Features to Look for in College Fund Apps

Not all financial apps are created equal. Some offer robust features tailored specifically for educational savings, while others focus more on general budgeting or micro-investing. When choosing an app to automate college fund deposits, there are key features that families should prioritize.

- Recurring transfer options – Flexibility to set weekly, biweekly, or monthly deposits.

- Goal tracking – Visual tools to help track progress toward specific tuition targets.

- Round-up contributions – Automatically saving spare change from purchases.

- Custodial account integration – Ability to link to 529 plans or other education-specific accounts.

- Notifications and reminders – Alerts that keep you informed and engaged without being overwhelming.

Apps that offer a combination of these features empower users to automate not just their money—but their mindset around college savings as well.

🔍 Comparing App Types: Budgeting vs. Investment-Focused

Some apps focus on pure savings, allowing users to move small amounts of cash into a dedicated college fund. Others take a more investment-oriented approach, placing those deposits into portfolios that can grow over time. Both have their merits, depending on the user’s timeline and risk tolerance.

Budgeting apps are great for those who want to stay in full control of contributions and avoid market volatility. Investment-focused apps, on the other hand, may offer greater long-term growth potential—ideal for parents starting when their child is still in elementary school.

📊 Real-Life Scenarios: What Can Automation Achieve?

Let’s consider a common scenario. A parent sets up an automated weekly transfer of $25 starting when their child is five years old. Without increasing the amount, and assuming a modest annual return of 5%, the fund would grow to nearly $30,000 by the time the child turns 18. That’s the power of early, consistent, and automated saving.

Now consider a student in high school with only three years until college. If they set aside $50 every two weeks through automation, they could accumulate close to $4,000 by graduation—enough to cover books, a semester of community college, or essential housing costs.

📱 How Apps Fit into Modern Student Lifestyles

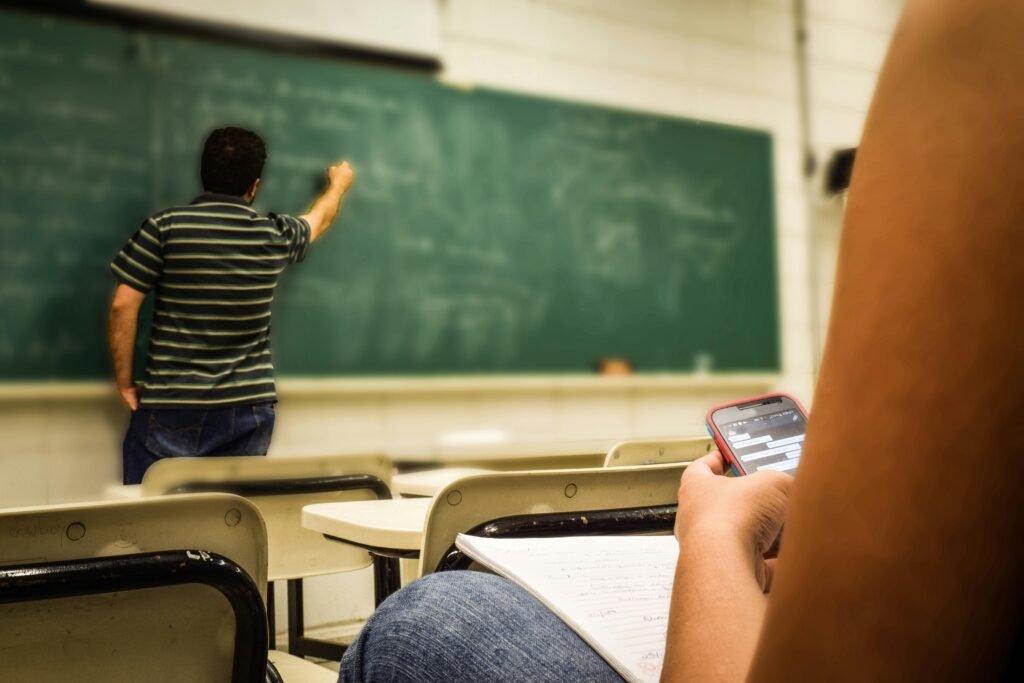

Today’s students live on their phones. Integrating saving habits into that mobile-first lifestyle makes automation not just effective, but intuitive. Many modern apps are designed with sleek interfaces, gamification, and real-time notifications that appeal to digital natives. Automation becomes part of their digital routine, just like checking social media or streaming music.

Several of the best financial literacy apps for beginners in 2025 now include automated saving features that make them ideal for college fund planning. These platforms combine education, motivation, and financial tools in one place—making it easier for users to understand not just how to save, but why it matters.

🎓 Choosing Between 529 Plans and Regular Savings Accounts

When automating deposits for college savings, one major decision is where to direct the funds. The two most common options are 529 savings plans and regular high-yield savings accounts. Each has its advantages depending on the family’s goals and circumstances.

- 529 Plans – Offer tax-advantaged growth and can be used exclusively for qualified education expenses. Some states even offer additional tax incentives.

- High-Yield Savings Accounts – Provide greater flexibility and are ideal for shorter-term goals or families unsure about future college needs.

Apps that integrate directly with 529 plans make it simple to automate tax-efficient contributions. Others allow transfers into flexible savings accounts that can be repurposed if needed.

📈 Why Earlier Is Always Better

The sooner you begin automating college fund deposits, the greater your potential for long-term growth. Time is the most valuable asset in compounding interest. Starting early also allows families to adjust contributions gradually, reducing stress and pressure later on.

Even if the initial amounts are small—$10 here, $20 there—those deposits add up. Over 10 to 15 years, automated contributions can turn a daunting goal into a manageable and even empowering process.

💬 The Emotional Side of Saving for College

Saving for college is more than a financial task—it’s an emotional journey. For parents, it often represents sacrifice, love, and long-term vision. For students, it can foster a sense of ownership, independence, and gratitude. Automating the process doesn’t remove the emotion—it enhances it. Each scheduled deposit becomes a quiet commitment to a brighter future.

Instead of feeling overwhelmed by the size of the goal, families can focus on consistency and progress. Automated apps provide the structure needed to turn stress into confidence, and fear into hope.

👨👩👧👦 Making Saving a Family Habit

Some apps allow multiple contributors—grandparents, aunts, uncles, or friends—to make automated deposits. This transforms college savings from a solo responsibility into a collective effort. Celebrating milestones as a family reinforces shared values and ensures that everyone feels connected to the student’s success.

When saving becomes a family tradition, it builds more than just financial stability—it creates emotional and generational wealth.

🔄 How Automation Apps Transform Habits into College Savings Power

Automatically depositing into a college fund isn’t just about money—it’s about shaping habits. By turning saving into something automatic, apps remove the need for willpower and decision fatigue. This shift transforms saving from a chore into a nearly invisible habit that supports long-term growth.

Once the system is in place, deposits happen without thought. That frees up energy to focus on earning, learning, and planning. Fans of behavioral finance know that removing friction—like skipping a manual transfer—raises the odds of consistent progress. And when it comes to college savings, consistency is more powerful than large one-time contributions.

🧩 Behavioral Design: The Psychology Behind Automated Saving

Many apps use behavioral design principles: nudges, gamification, goal visuals, and progress notifications. These elements make saving feel enjoyable—and less abstract. Rather than viewing deposits as sacrifices, users begin to see them as steps toward a meaningful goal—a funded education, reduced debt, and future opportunity.

📱 Popular Types of Savings Apps That Support 529 Plans

Certain financial apps are designed or compatible with 529 plans, allowing users to automate deposits directly into tax-advantaged education accounts. These include robo-advisors, budgeting tools with partner integrations, and even dedicated platforms designed specifically for educational savings.

For those exploring these tools, it’s useful to consult guidance like Simple Ways to Automate Your Financial Life Like a Pro. That article reviews automation beyond college funds—including flexible transfers, round-ups, and recurring investments—which often overlap with educational-planning tools. Such resources provide context on why automation works so effectively.

📋 What Smart Apps Offer for College Savings

- Integration with bank and brokerage accounts – Seamless funding to 529 or custodial accounts

- Automatic round-up transfers – Spare change contributes to your fund

- Custom target settings – Set tuition goals by age or year and let the app calculate deposits

- Shared contributor access – Allow trusted family members to contribute

- Progress-driven feedback – Visual cues and milestone rewards reinforce momentum

💡 Top Features to Prioritize When Choosing Apps

Not all savings automation tools are built for college planning. Look for apps that allow flexible schedules (weekly, bi‑weekly, monthly), adjust contribution amounts, pause or redirect funds, and sync with official 529 plan providers or custodial accounts.

Also check whether the app supports multiple contributors and notifications. The psychological benefit of seeing shared deposits—and getting recognized for small wins—can be a powerful motivator to stay consistent.

⚖️ Budgeting vs Investment Mode: What’s Right for You?

Some apps focus on budgeting and saving, giving you fixed transfers into cash accounts. Others invest the funds in market-based portfolios that may offer higher long-term growth—but also carry risk. Your choice depends on your timeline, comfort with market fluctuations, and the flexibility you need.

📈 Real-World Example: From Spare Change to $20K+

Consider someone who uses an app’s round-up feature to add an average of $15 per week to a separate savings bucket. Over 15 years, even with modest interest, that small automation results in over $12,000. If paired with scheduled transfers, it can easily exceed $20K—showing how micro contributions compound meaningfully over time.

This effect is especially valuable for families with fluctuating income, like gig workers or seasonal earners. Automation provides predictability and progress, even when bank balances vary month to month.

🌐 Integration and Multi-Channel Input

Leading platforms let contributors deposit via bank account, debit card, or even automated payroll deductions. Some support Zelle or ACH, allowing gift contributors—like grandparents—to add funds seamlessly. This flexibility promotes community support, helping a wider network participate in the student’s journey.

🧠 Aligning Automation with Emotional Motivation

Saving for college isn’t just practical—it’s emotional. Each automated deposit can represent belief, commitment, and hope. Seeing progress over time builds emotional momentum. This aligns adult savers and students with a shared vision of educational achievement.

Apps that include reminders or customizable messages—like “You’re one step closer to college!”—can maintain engagement. These emotional triggers reinforce consistent habits and strengthen purpose.

⚙️ Managing Downs and Interruptions Gracefully

Life happens: job changes, medical bills, or unexpected expenses can disrupt plans. Smart automation apps include features to pause, reduce, or redirect contributions temporarily—without penalty or emotional guilt. This built‑in flexibility turns saving into a resilient system, not a rigid rule.

📊 How to Audit Your Automated Savings Strategy

Regular reviews ensure your automation is still aligned with your goals. Schedule quarterly audits to check contribution levels, growth rate, and tuition estimates. Use app dashboards or export statements if needed to maintain clarity.

📝 Audit Checklist for Automated College Savings

- Confirm recurring transfer amounts

- Review accrued balance and projected growth

- Adjust contribution timing or amount if plans shift

- Verify synchronization with 529 or custodial account provider

- Pause or redirect deposits if major life changes occur

🤝 Bringing Family Into the Process

Enabling multiple contributors (like relatives or guardians) increases both funding and emotional connection. Shared dashboards let contributors see growth and celebrate progress. Apps that support gift links or shared access turn savings into a communal experience instead of an isolated task.

This shared involvement reinforces values, reduces financial pressure on any single person, and increases the likelihood of long-term consistency—even if contributions are modest.

🚀 Scaling Your College Fund: From Small Deposits to Big Impact

As automated deposits grow, so does confidence. What starts as ten or twenty dollars a week evolves into substantial momentum. The key is consistency paired with periodic evaluation. Over time, small, habit-driven contributors become larger, strategic investments that carry real weight.

Whether you’re saving for a semester abroad, private university tuition, or just reducing student loan reliance, scalable automation empowers users to adjust as needs change. It gives room to grow, adapt, and refine the strategy year after year.

📆 Scheduled Increases: Building Momentum Over Time

Many apps allow you to schedule incremental increases—like raising your weekly deposit by $5 every year or matching a raise automatically. This feature aligns with income growth and evolving educational costs.

Periodically increasing deposits makes the fund feel more dynamic and adaptive—never stagnant. It ensures savings pace keeps up with rising tuition without requiring manual recalculations.

🔄 Redirection and Pause: Flexibility Built In

Life is unpredictable. Smart automation apps let users pause or redirect savings—perhaps shifting funds temporarily into a rainy-day account or lower-risk savings vehicle. This flexibility ensures savings aren’t derailed by short-term stressors.

⚠️ Temporary Suspension Without Losing Progress

High-quality platforms understand that conservation doesn’t mean abandonment. A temporary pause isn’t failure—it’s strategic adaptation. Users can resume contributions when circumstances stabilize, and the system retains full history and projection.

🤓 Keeping Motivated with Smart Notifications and Rewards

Many apps embed motivational features: badges for milestones, celebratory messages as you hit savings goals, and reminder notifications. These features foster emotional connection to the process, making saving feel rewarding—rather than burdensome.

- Milestone badges (e.g., “First $1,000 saved”)

- Progress graphs tied to goal timelines

- Friendly reminders (e.g., “Your college fund deposit is scheduled for tomorrow.”)

- Occasional congratulatory messages on anniversaries or contributions

🎯 Using Behavioral Rewards to Sustain Momentum

These small forms of celebration—although digital—can drive sustained behavior. They reinforce the habit loop and turn saving into an emotionally satisfying activity.

📚 Connect Savings Automation to Financial Education

Automation works best when paired with understanding. Apps that integrate educational content—videos, articles, interactive lessons—help users understand why saving matters and how to optimize it over time.

Some platforms link to broader financial literacy resources. For example, articles like How to Manage Part‑Time Job Taxes as a College Student offer context and practical guidance that complements automated saving strategies.

📌 Learning While You Save

By combining automation with learning modules—such as tax implications, financial planning, and investment basics—users gain deeper insight and confidence in their actions. This integration reinforces long‑term thinking and responsible decision-making.

💡 Choosing the Right App for Your Situation

Your ideal app depends on your goals:

- Shorter timelines (1–3 years): Choose budgeting or savings-focused apps that limit risk.

- Longer-term goals (10+ years): Consider investment-based platforms that offer growth potential aligned with expected tuition inflation.

- Multiple contributors: Opt for apps with shared access or gift links.

- Flexible pause options: Essential for unpredictable financial scenarios.

🧭 Prioritizing Educational and Emotional Fit

Beyond features, an app should feel intuitive and emotionally safe. You want reassurance—not confusion—especially when handling family finances and college aspirations.

❤️ Conclusion

Automating college fund deposits transforms saving from a chore into a sustainable, emotional, and strategic process. The combination of routine, flexibility, motivation, and education builds not just funds—but financial resilience and peace of mind. Every automated deposit becomes a silent promise to the future—of opportunity, independence, and confidence.

❓ FAQ

Q: Can I pause contributions temporarily without closing my account?

Yes. Most automation apps support temporary pauses or redirection of funds without impacting your account’s history or goals. This allows flexibility in case of life events—while keeping your savings trajectory intact.

Q: Is it safe to invest automated college savings instead of keeping it in cash?

Investment-based apps offer growth potential but carry risk. If your timeline is long (10 years or more), investing may offer more returns. For shorter timelines, or when risk tolerance is low, a high-yield savings account may be safer.

Q: How do multiple contributors influence tax and account structure?

Many apps support gift contributions via ACH, payment links, or shared dashboards. As long as contributions go into education-qualified accounts (like a 529), the tax treatment remains favorable. Check your state’s guidelines for specific limits and rules.

Q: How often should I audit my automated savings strategy?

Conduct quarterly audits to review deposit amounts, projected growth, and alignment with tuition estimates. Adjust as needed based on tuition inflation, income changes, or changed goals. A proactive approach keeps expectations grounded and progress on track.

This content is for informational and educational purposes only. It does not constitute investment advice or a recommendation of any kind.

Navigate student loans, budgeting, and money tips while in college here: https://wallstreetnest.com/category/college-student-finances