🎓 Why the ROI of a College Degree Matters Now More Than Ever

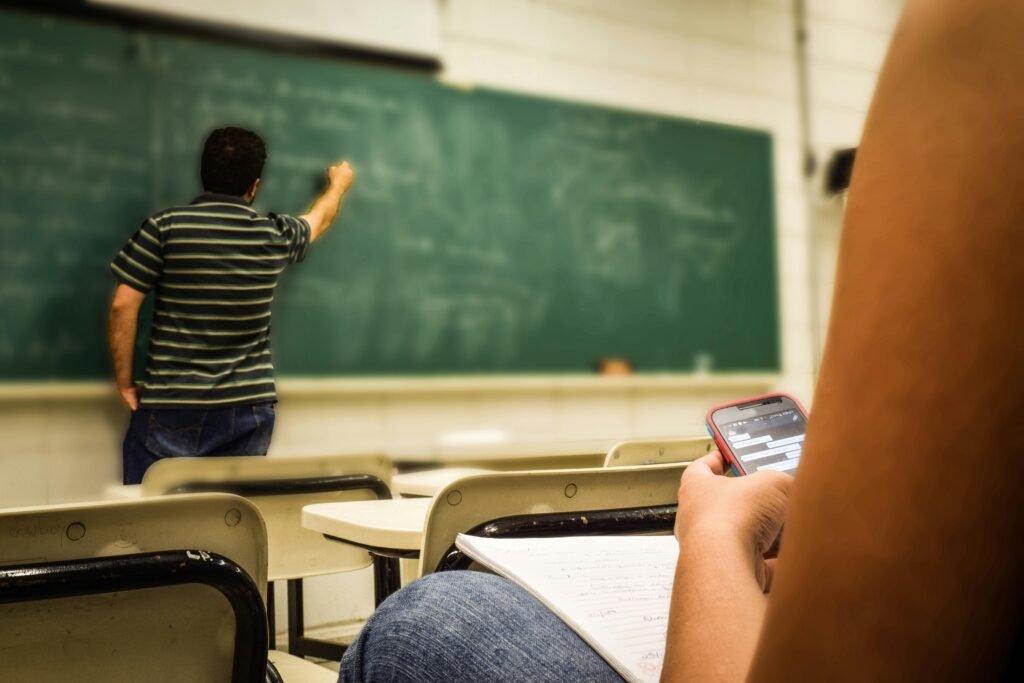

The return on investment (ROI) of a college degree by major has become a central topic for students and families facing skyrocketing tuition costs and an uncertain job market. As the cost of higher education continues to rise, understanding which majors lead to stronger financial outcomes is no longer optional—it’s essential. Evaluating ROI helps students make data-driven decisions about their future, especially as student debt becomes harder to justify without clear long-term benefits.

Unlike the past when a degree of any kind almost guaranteed a solid career, today’s job market rewards specialization, adaptability, and relevance. That’s why evaluating how much you invest—both in tuition and time—compared to how much you’re likely to earn, is key to making smarter education choices. It’s not just about passion; it’s about balancing it with pragmatism.

📊 The Formula: Cost vs. Earnings Potential

To understand degree ROI, start by comparing the total cost of earning the degree with the potential median earnings after graduation. This often includes tuition, fees, living expenses, and interest on loans. Then contrast this with salary expectations within 1, 5, and 10 years after graduation. High ROI majors generally offer higher salaries relative to cost, allowing graduates to repay debt faster and build wealth earlier.

For example, degrees in engineering, computer science, and nursing often yield strong returns thanks to high starting salaries and consistent demand. Meanwhile, many humanities and fine arts degrees—while valuable in other ways—tend to yield lower earnings that may not justify the same financial investment unless supplemented with graduate education or entrepreneurial strategies.

💸 Majors With the Highest Return on Investment

ROI rankings vary by school, region, and industry, but consistently, STEM (science, technology, engineering, and mathematics) degrees dominate the top of the charts. These fields offer specialized skill sets that employers are actively seeking, and the job outlook is strong across various sectors.

- Computer Science: High demand across industries, strong entry-level pay, and upward mobility.

- Nursing: Critical workforce need, job stability, and competitive wages even with associate degrees.

- Engineering (various disciplines): Top-tier salaries, especially in petroleum, electrical, and computer engineering.

- Finance and Accounting: High ROI when paired with certifications like CPA or CFA.

One powerful strategy to boost ROI, especially for students in any major, is to proactively limit reliance on loans. There are effective ways to fund college without burying yourself in debt. For instance, understanding [how to pay for college without taking out student loans](https://wallstreetnest.com/how-to-pay-for-college-without-taking-out-student-loans/) can shift your financial trajectory from day one of your academic journey.

📈 Long-Term vs. Short-Term ROI

While high-paying fields offer early financial benefits, some degrees provide better long-term ROI with experience and specialization. For instance, liberal arts degrees may not yield strong salaries immediately, but graduates who pivot into law, management, or entrepreneurship often find themselves earning competitively a decade later.

In contrast, some vocational or technical degrees offer excellent short-term ROI but may plateau in earnings over time without further education. Students should evaluate not just entry-level salaries but also growth potential, industry longevity, and opportunities for advancement.

🎭 Low ROI Majors: Risk or Misunderstood Opportunity?

Majors in arts, humanities, and education often come with a lower financial ROI, especially in the early years post-graduation. But the story doesn’t end there. Many of these fields provide intrinsic rewards, social impact, and pathways into high-level careers when strategically paired with networking, graduate programs, or entrepreneurial ventures.

Still, students in these fields should be cautious about over-borrowing and should explore scholarships, employer sponsorships, and side hustles to mitigate risk. Knowing the financial realities upfront allows for better planning and reduces the likelihood of borrower’s remorse.

📚 Balancing Passion and Practicality

Choosing a major shouldn’t feel like choosing between purpose and a paycheck. The key is to strike a balance. Students can pursue their passions while being mindful of economic outcomes by combining interests with in-demand skills, such as pairing English with data analytics or psychology with business courses.

This interdisciplinary approach allows students to maintain personal fulfillment while still enhancing their marketability. Many employers are increasingly valuing soft skills, critical thinking, and creativity—so the right positioning can turn even a “low ROI” degree into a launchpad for success.

🔍 How Institutional Choice Impacts ROI

ROI isn’t just about what you study—it’s also about where. Some universities offer exceptional ROI for certain majors due to strong employer pipelines, internship networks, or location-based advantages. Others may charge higher tuition without delivering proportionate job placement support or salary outcomes.

To assess institutional ROI, consider factors like average graduate salary, student loan default rate, graduation rate, and post-graduation employment data. Public universities and community colleges often provide better ROI than private institutions for non-STEM majors, simply due to lower upfront costs and similar job outcomes.

🏫 Prestige vs. Affordability

Elite schools may offer strong networking advantages and brand recognition, but the premium in tuition isn’t always justified if it doesn’t result in significantly higher earnings. Unless attending with financial aid or a scholarship, students should weigh whether the prestige premium aligns with their intended major’s earning potential.

For many students, a practical option is to begin at a community college and transfer credits to a four-year institution, reducing total cost while maintaining quality education—a strategy that can dramatically boost ROI.

📌 The Role of Student Debt in ROI Calculations

For many students, the cost of borrowing is the most critical factor in their ROI equation. With interest rates that can accrue rapidly and repayment terms that last decades, student loans represent more than just a temporary burden—they directly affect financial milestones like buying a home, starting a family, or saving for retirement. The higher the debt-to-income ratio after graduation, the lower the ROI of the degree.

Therefore, choosing majors with strong post-graduation income becomes especially important when loans are involved. Students in lower-earning fields must be cautious about overleveraging and should opt for less expensive institutions or part-time paths to reduce total debt exposure.

💡 Why Borrowing Strategically Matters

Not all loans are equal. Federal student loans come with income-driven repayment plans and forgiveness options, which can protect graduates in lower-paying fields. On the other hand, private loans often have fewer safeguards and should be minimized wherever possible. Students and families should understand the full terms of any borrowing arrangement before committing.

It’s also essential to evaluate whether certain types of loans align with long-term goals and career paths. For example, some families consider Parent PLUS Loans to bridge funding gaps. However, this option can come with higher interest rates and fewer protections, and families should be well informed before committing. For more detailed insight, explore this resource on [whether you should choose Parent PLUS loans for college costs](https://wallstreetnest.com/should-you-choose-parent-plus-loans-for-college-costs/).

🏆 The Importance of Completion Rates and Graduation Timelines

ROI is also significantly affected by how long it takes a student to graduate. Taking five or six years to complete a four-year degree can drive up costs dramatically—not just in tuition, but also in lost earnings from delayed entry into the workforce. Moreover, students who drop out without a degree are left with the burden of debt but without the credential needed to boost income.

Completion rates vary widely by major, with STEM fields generally showing higher persistence and graduation outcomes due to structured curriculums and career clarity. Meanwhile, majors with fewer immediate career paths may see higher attrition as students reevaluate goals mid-program.

🎯 Tips to Stay on Track

- Meet with an academic advisor each semester to ensure timely progress toward graduation.

- Take advantage of credit-for-prior-learning or AP/IB credits to reduce total semesters required.

- Enroll in summer or winter courses to maintain momentum.

- Choose majors with clear degree maps and fewer elective ambiguities.

Every extra semester has both a direct cost (tuition, books, housing) and an opportunity cost (lost wages), so timely graduation is one of the most reliable ways to protect ROI regardless of major.

📍 Regional Differences in Earnings by Major

The location where you study and eventually work plays a huge role in the ROI of your degree. For example, an elementary education graduate working in California may earn significantly more than one working in Mississippi, even with the same credentials. Similarly, tech degrees tend to have higher starting salaries in metropolitan hubs like San Francisco, Seattle, or Austin.

This regional variation affects both the numerator and denominator in your ROI calculation—salaries may be higher in certain areas, but so are living expenses. Students should be aware of cost-of-living differences and consider relocating to boost income or lower expenses, depending on their industry.

🌍 Careers That Travel Well

Some degrees offer more geographic flexibility than others. For example, nursing, IT, and business degrees are transferable across states and even internationally. Others, like teaching or law, are more locally regulated and may require additional licensing. Knowing how portable your degree is helps ensure a stronger ROI across life transitions.

📚 The Graduate School Factor

For many majors, a bachelor’s degree is just the beginning. Some fields—particularly in psychology, social work, law, or academia—essentially require graduate degrees for meaningful employment. When calculating ROI, students should consider not only the cost of the undergraduate program but also the likely necessity and cost of graduate education.

This is especially relevant in fields where the undergraduate degree provides limited direct job prospects. In these cases, students must evaluate whether the total investment (bachelor’s + master’s or doctorate) will ultimately yield competitive earnings and justify the extended debt burden.

📈 ROI Beyond Salary

Not all returns are strictly financial. Some majors may lead to careers that offer exceptional job satisfaction, personal fulfillment, or societal impact. While these benefits are harder to quantify, they matter. However, students should still ground their choices in a realistic understanding of financial tradeoffs to avoid long-term stress or regret.

In some cases, a lower-paying but fulfilling career path may be sustainable if students take measures to avoid debt, such as working during school, pursuing scholarships, or choosing in-state institutions. Careful planning enables students to follow their passion without sacrificing long-term financial security.

💼 Internships and Industry Exposure: Multiplying ROI

Majors that embed internships, cooperative education, or real-world experiences into their curriculum often offer a significantly higher ROI. Students gain valuable experience, build professional networks, and improve job readiness—all of which shorten the time between graduation and stable employment.

Even in fields with lower average salaries, a strong internship or mentorship can open doors to higher-paying niche roles, startup involvement, or alternative paths like consulting or freelancing. Early exposure gives students a competitive edge in crowded job markets.

💼 Majors Where Internships Are Crucial

- Journalism: Experience with local publications or online platforms is essential to break into the field.

- Marketing: Employers seek hands-on campaign experience, even at entry level.

- Engineering: Many firms prefer candidates with co-op program completion or technical project portfolios.

- Education: Student teaching or classroom placements often determine hiring outcomes.

Internships also serve as a litmus test for whether the major aligns with the student’s real-world interests and strengths, helping prevent costly mid-degree changes or regret after graduation.

🛠️ Dual Majors and Minors That Enhance ROI

Strategic pairing of majors and minors can significantly enhance career opportunities and earning potential. For instance, a philosophy major who minors in data science becomes uniquely positioned for roles that require ethical reasoning and analytical skills. Likewise, a music major who adds a minor in business is better prepared to manage their career as an artist or educator.

Some of the most effective combinations include:

- Psychology + Business: Opens doors to human resources, marketing, and organizational consulting.

- English + Communications: Ideal for PR, media, and digital content creation roles.

- Environmental Science + Policy: Prepares students for government, advocacy, or regulatory work.

- STEM Major + Foreign Language: Expands global employability in technical industries.

📌 Consider Employability, Not Just Interest

While pursuing your interests is important, the additional credential should also serve a market demand. Choose minors that strengthen technical skills, provide certification eligibility, or fill knowledge gaps commonly cited in job descriptions. This approach builds flexibility into your degree and strengthens overall ROI.

📊 How Salary Growth Over Time Influences ROI

One of the most overlooked factors in assessing degree ROI is how salaries evolve throughout a career. While some majors offer high starting salaries, their growth trajectory may flatten quickly. Others begin modestly but increase steadily over time due to specialization, promotions, or additional credentials.

For example, a graduate in computer science may earn $70,000 right out of college but see only moderate annual growth unless they move into management or niche areas. On the other hand, a public policy major may start at $45,000 but could earn $100,000+ after completing a master’s and working in government or consulting roles. Understanding long-term earnings growth helps provide a more accurate picture of true ROI.

📈 Tracking Median Lifetime Earnings

To assess a major’s full financial potential, students should consider lifetime earnings estimates rather than only entry-level salaries. Resources like the U.S. Census Bureau and labor market analytics offer data on median income by field and experience level. When paired with the total cost of education, this gives a more balanced perspective on value and payoff.

🧠 Non-Monetary ROI: Skills, Access, and Identity

Not all value derived from a degree shows up in a paycheck. College often provides critical thinking, networking, research, and communication skills that benefit individuals across their personal and professional lives. Furthermore, attending a university can offer social capital, mentorship, and access to exclusive alumni networks that influence long-term opportunities.

In some cases, a major becomes part of one’s identity and societal role. For example, those who major in ethnic studies, gender studies, or the arts may contribute to cultural transformation, activism, and educational reform. These contributions are difficult to monetize but are deeply meaningful and often worth the investment when paired with smart financial planning.

📚 Learning as a Lifelong Asset

Knowledge gained through a degree doesn’t expire after graduation. It can be leveraged for entrepreneurship, community leadership, or further education decades later. Students who view their major as a launching point rather than a single path are better positioned to adapt and thrive in evolving markets.

💰 Balancing Passion With Practicality

Choosing a college major is a deeply personal decision—one that should account for both financial outcomes and personal fulfillment. Ideally, students will find a field that aligns with their interests and talents while also offering financial sustainability. For many, this balance requires compromise, creativity, or additional planning to make their passion economically viable.

For example, a student passionate about theater might pursue a second major in communications or digital marketing to broaden their employment options. This type of planning empowers students to pursue meaning while still achieving strong ROI.

🎨 Making Passion Profitable

Students in creative or nonprofit-oriented fields can improve their ROI by:

- Building business or tech skills alongside their primary discipline

- Freelancing or interning during school to develop marketable portfolios

- Seeking post-grad fellowships or graduate assistantships that reduce debt

- Exploring hybrid careers (e.g., teaching art, managing creative projects)

ROI is not about sacrificing one’s dream. It’s about understanding the financial landscape clearly enough to pursue it responsibly and sustainably.

🔍 Transparency and Misinformation in College Marketing

Another factor impacting ROI is the lack of transparency in how institutions advertise outcomes. Many schools promote high-level employment stats without breaking down by major, leaving students with the false impression that all degrees offer equal economic return. Moreover, some programs fail to disclose low placement rates, underemployment, or inflated salary projections.

Students should research independently, using third-party resources and government databases like the College Scorecard to verify graduation rates, debt averages, and post-graduation income. When it comes to investing tens of thousands of dollars, due diligence is not optional—it’s essential.

📋 Questions to Ask Before Choosing a Major

- What is the average debt for graduates in this major at this school?

- What percentage of graduates work in their field within 6 months?

- Are there built-in internships, co-ops, or certifications?

- Does this major typically require graduate school?

- What are the regional salary expectations in this field?

📌 Financial Tools to Help Maximize Degree ROI

Aside from careful major selection, students can take proactive steps to improve the financial outcome of their education. Budgeting, part-time work, scholarships, and student discounts can minimize unnecessary borrowing. Strategic course planning and community college transfers can reduce total tuition costs.

Importantly, students should explore all available funding options before resorting to loans. This includes grants, work-study, employer tuition assistance, and merit-based aid. For those aiming to graduate debt-free or with minimal borrowing, it’s crucial to map out a financial strategy early. To explore practical ways to reduce dependency on student debt, read this guide on how to pay for college without taking out student loans.

🏁 Final Thoughts: Empowering Students Through Clarity

Understanding the real ROI of a college degree by major gives students power. It replaces guesswork with evidence, wishful thinking with data. It encourages students to dream boldly—but also to plan wisely. Education is one of the most important investments a person can make, and it should be guided by both aspiration and accountability.

The right major, pursued at the right cost and supported by smart financial decisions, can yield exponential returns—not just in salary, but in confidence, contribution, and lifelong opportunity.

❓ FAQ: Understanding Degree ROI

What major has the highest ROI?

Engineering and computer science consistently rank among the top for ROI due to high starting salaries and strong long-term demand. However, ROI also depends on the cost of the degree and how quickly students enter the workforce.

Is it worth it to major in liberal arts?

Liberal arts degrees can offer value when paired with marketable skills or graduate credentials. While they may lead to lower entry-level pay, they foster critical thinking and adaptability, which are valuable in many fields.

How do I know if a major is financially worth it?

Calculate total educational costs versus projected lifetime earnings. Research employment rates, salary data, and debt outcomes by major. Also consider if the degree requires further education to be marketable.

What if I want to change my major?

Changing majors can affect ROI by increasing the time and cost to graduate. Students should speak with an advisor, evaluate transferable credits, and consider dual majors or minors to stay on track.

This content is for informational and educational purposes only. It does not constitute investment advice or a recommendation of any kind.

🎓 Final Resource

Navigate student loans, budgeting, and money tips while in college here: https://wallstreetnest.com/category/college-student-finances